Ta intryck eller anstöt av detta?

Ur min synvinkel, kanske inte din…

Kontrollera dina källor!

Sextio av världens nationer är medlemmar i detta samarbete. BIS fungerar som centralbankers bank.

De publicerade i januari 2020 en omfattande rapport där klimatförändringar är en betydande komponent. https://www.bis.org/publ/othp31.pdf

Climate change poses new challenges to central banks, regulators and supervisors. This book reviews ways of addressing these new risks within central banks’ financial stability mandate. However, integrating climate-related risk analysis into financial stability monitoring is particularly challenging because of the radical uncertainty associated with a physical, social and economic phenomenon that is constantly changing and involves complex dynamics and chain reactions. Traditional backward-looking risk assessments and existing climate-economic models cannot anticipate accurately enough the form that climate-related risks will take.

https://en.wikipedia.org/wiki/Bank_for_International_Settlements

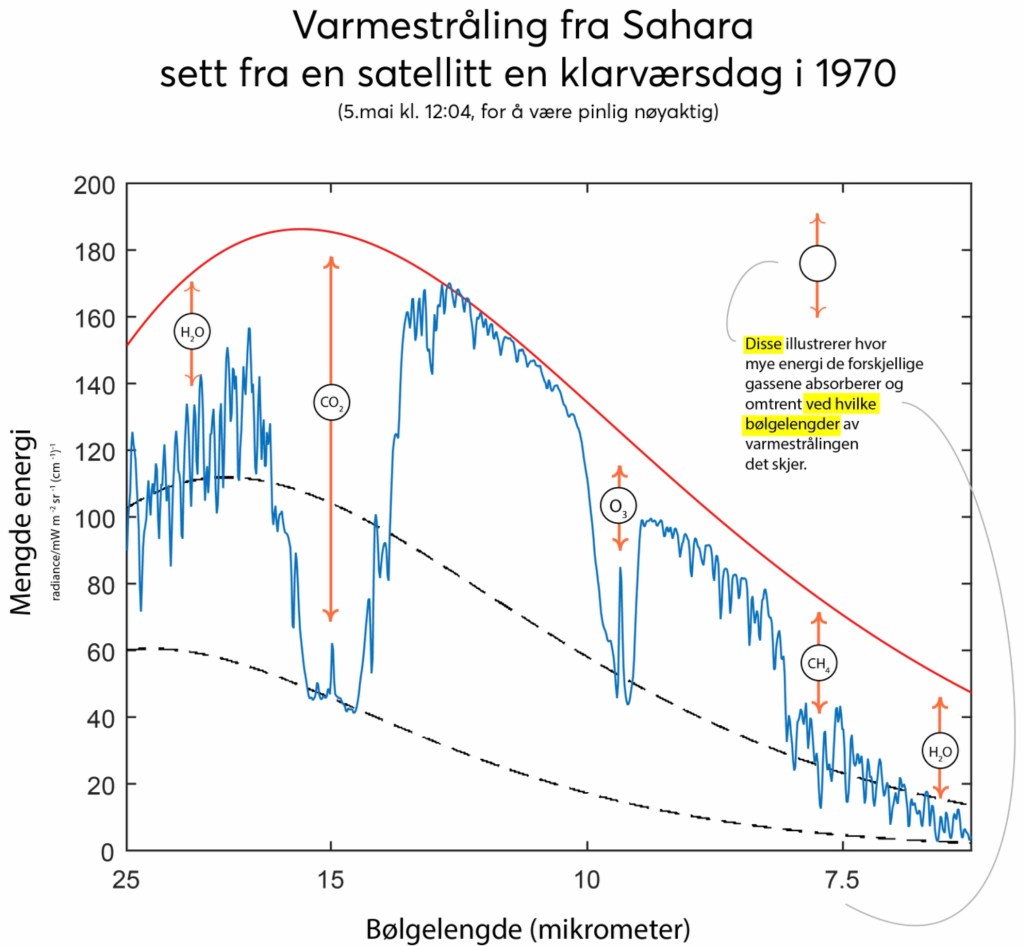

Grafiken förklaras detaljerat i länken.

https://cicero.oslo.no/no/posts/single/drivhuseffekten-for-viderekomne

https://www.bbc.com/news/amp/world-asia-51691967?

NO2 är en markör för allvarlig luftförorening som kan spåras och mätas via satelliter: https://sv.wikipedia.org/wiki/Kvävedioxid

J.P. Morgan is the world’s largest financial backer of fossil fuel companies, helping to fund fracking, pipeline projects, and Arctic oil and gas exploration. The company has contributed $75 billion to such projects since the Paris climate agreement was forged in 2015. The agreement called on governments to reduce fossil fuel emissions to help limit global heating to 1.5° Celsius above pre-industrial temperatures.

If activities like the ones funded by J.P. Morgan continue to release fossil fuels into the atmosphere, Murray and Mackie wrote, ”We cannot rule out catastrophic outcomes where human life as we know it is threatened.”

Källa till rapporten: Sök ”JP Morgan – Risky business – the climate and the macroeconomy – 2020-01-14_3230707.pdf-1”

In the 800,000 years prior to the industrial revolution, the atmospheric concentration of CO2 oscillated in a range from 170ppm (parts per million) to 300ppm. This ebb and flow in CO2 emissions was mainly driven by volcanic activity and ocean fissures. Since the industrial revolution, CO2 concentrations have climbed dramatically to the current level of around 410ppm (Figure 1).This increase in CO2 concentrations reflects the burning of fossil fuels for electricity generation and transportation, industrialization, and changes in agriculture and land use (deforestation).

Notera tidsskalan. Mänskligheten började evolvera till nuvarande form för 200 – 100 kyr sedan och spred sig så sakta från Afrika vid 50 kyr sedan. (Detta är inga definitiva siffror, mer de som är vanliga.)

Notera tidsskalan. Mänskligheten började evolvera till nuvarande form för 200 – 100 kyr sedan och spred sig så sakta från Afrika vid 50 kyr sedan. (Detta är inga definitiva siffror, mer de som är vanliga.)

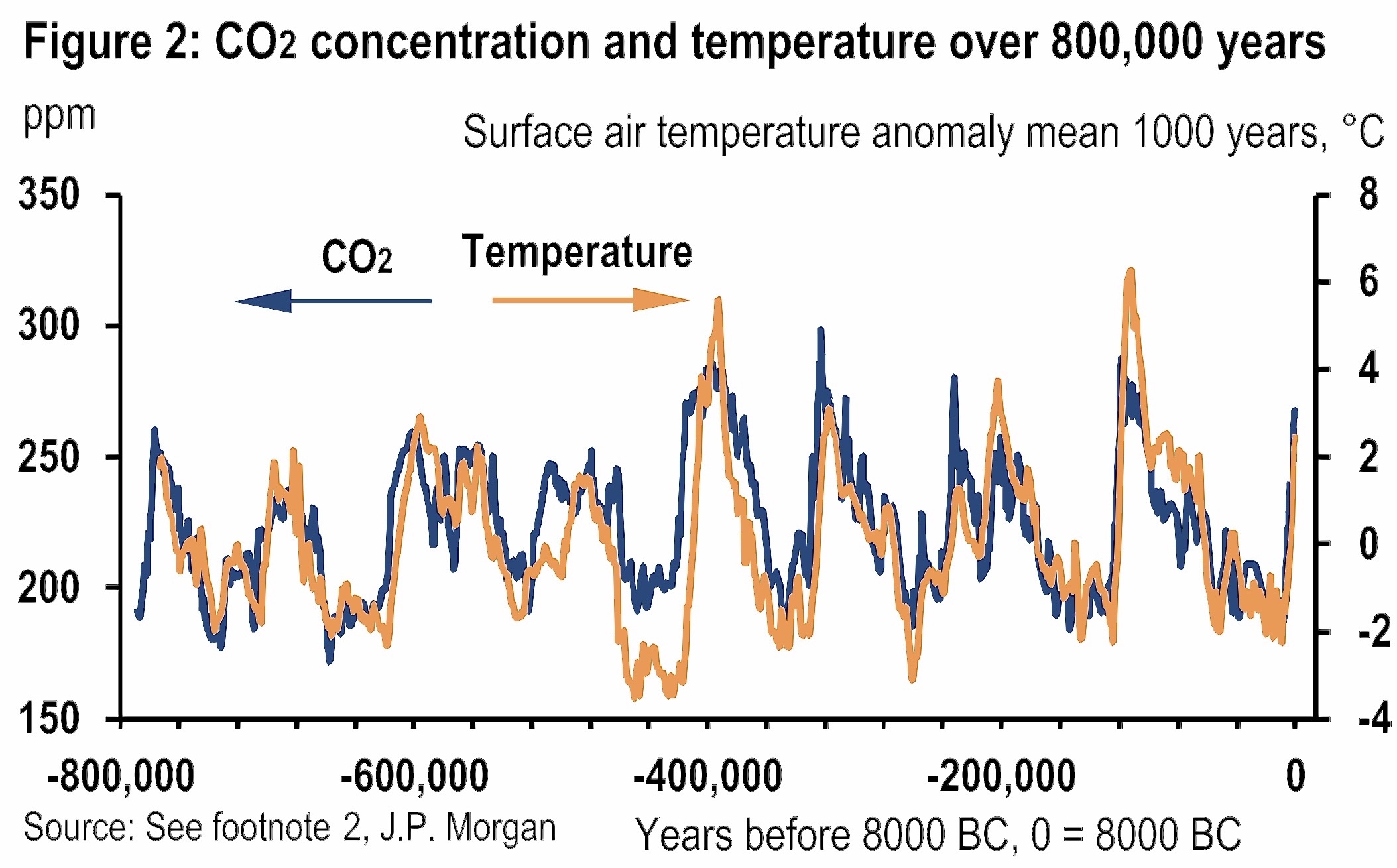

There has been a relatively close relationship between CO2 concentrations and temperature over the last 800,000 years (Figure 2). 2 These long run estimates of CO2 concentrations and temperature are based on ice core data from Antarctica so they are not estimates of global conditions. But the impression is very strong. Over the last 800,000 years, through to the middle of the 19th century, as CO2 concentrations oscillated in a 170ppm to 300ppm range, the Antarctic temperature oscillated in a range from -3.5°C to +6.3°C (relative to the average temperature over the last 1000 years).

Jag vet att det finns de som inte inser växthusgasers (GHG) betydelse som klimatpåverkare. Man hävdar att deras andel är extremt liten och därmed betydelselös. GHG ökar mängden vattenånga i atmosfären så att den gör grovjobbet med IR-reflektion tillbaka mot Jorden. Hittills har systemet fungerat rätt hyfsat, det har höjt Jordens medeltemperatur med cirka 33°C, från -18°C till 15°C.

Footnote 1: Lüthi et al, High-resolution carbon dioxide concentration record 650,000-800,000 years before present. Nature, Vol. 453, pp. 379-382, 15 May 2008.; Petit et al, Climate and atmospheric history of the past 420,000 years from the Vostok ice core, Antarctica, Nature 399: 429-436.; C. D. Keeling et al, Exchanges of atmospheric CO2 and 13CO2 with the terrestrial biosphere and oceans from 1978 to 2000. I. Global aspects, SIO Reference Series, No. 01-06, Scripps Institution of Oceanography, San Diego, 88 pages, 2001.

Footnote 2: Lüthi et al, High-resolution carbon dioxide concentration record 650,000-800,000 years before present. Nature, Vol. 453, pp. 379-382, 15 May 2008; Friedrich, T. et al., Nonlinear climate sensitivity and its implications for future greenhouse warming, Science Advances, Vol. 2, 2016

Då mina kunskaper om coronavirus är små tänker jag inte försöka kommentera närmare. Det finns det andra som gör, en del tycks insatta i ämnet, andra kommenterar ändå.

Johns Hopkins har ett par varianter av kartor som följer spridning och utfall i nära realtid. https://hub.jhu.edu/2020/01/23/coronavirus-outbreak-mapping-tool-649-em1-art1-dtd-health/

Mobil version: https://www.arcgis.com/apps/opsdashboard/index.html#/85320e2ea5424dfaaa75ae62e5c06e61

Version för större skärmar (bilden härunder): https://www.arcgis.com/apps/opsdashboard/index.html#/bda7594740fd40299423467b48e9ecf6

# Climate change is a slow-moving process, but it is no less danger-

ous for that. It is likely to be one of the key defining features of the

coming decades. The longer action is delayed the more costly it will

be to deal with the issues. Moreover, a delayed policy response

opens us up to potentially catastrophic outcomes, which might be

impossible to reverse.

# This report examines climate change in three sections: the mechan-

ics of climate change; the impact of climate change; and the re-

sponse to climate change.

# The mechanics of climate change considers the journey from hu-

man activity to CO2 emissions, from CO2 emissions to atmospheric

CO2 concentrations, from atmospheric CO2 concentrations to the

global temperature and from the global temperature to the global

climate. The climate system is complex, non-linear and dynamic.

There is considerable inertia in the system so that emissions in the

coming decades will continue to affect the climate for centuries to

come in a way that is likely to be irreversible. Uncertainty is en-

demic, not just about modal effects but also about the shape of the

probability distributions, especially how fat the tails are.

# The impact of climate change is broad based covering GDP, the

capital stock, health, mortality, water stress, famine, displacement,

migration, political stress, conflict, biodiversity and species surviv-

al. Uncertainty is endemic here as well, trying to evaluate the im-

pact of a climate that the earth hasn’t seen for many millions of

years. Empirical estimates based on the variability of the climate in

recent decades likely massively underestimate the effects.

# The response to climate change should be motivated not only by

central estimates of outcomes but also by the likelihood of extreme

events (from the tails of the probability distribution). We cannot

rule out catastrophic outcomes where human life as we know it is

threatened.

# To contain the change in the climate, global net emissions need to

reach zero by the second half of this century. Although much is

happening at the micro level, it is hard to envisage enough change

taking place at the macro level without a global carbon tax.

# But, this is not going to happen anytime soon. Developed econo-

mies, who are responsible for most of the cumulative emissions,

worry about competitiveness and jobs. Meanwhile, Emerging and

Developing economies, who are responsible for much less of the

cumulative emissions, still see carbon intensive activity as a way of

raising living standards. It is a global problem but no global solu-

tion is in sight.

Rapporten, daterad 14/2 2020, är på 20 späckade sidor, detta är en sammanfattande inledning. Den inte officiellt publicerad utan avsedd för investmentbankens kunder. Sök på ”Risky business the climate and the macroeconomy”

J.P. Morgan är en gigant i bankvärlden [1]. De förvaltar enorma kapital och med tanke på gångna händelser vill de inte utsätta sina kunder för framtida förlustrisker utöver de kalkylerade.

Jo, datorrösten stör mig också, men återger en rimlig sammanfattning av 20 späckade sidor. Rapporten är inte officiell utan avsedd för investerare. Prova att söka på ”Risky business: the climate and the macroeconomy”.

Då den är minst sagt faktaspäckad kommer jag framöver att referera och kommentera den portionsvis.

Jag tänker inte diskutera deras etik eller moral.